what are large banks in asia doing in regards to fintech

The Super App Revolution

Super Apps, the “One app to do it all” concept that became popular in China has now become a global phenomenon.

Paytm, India’south largest mobile payments and e-commerce platform tin exist safely called India’s first Super App. It allows users to do multiple things like transfer money, purchase aureate, book tickets, and even make hotel reservations. Soon, Paytm has over 150 million+ monthly active users and the highest marketplace share in offline merchant payments with xv% month-on-calendar month growth. Paytm has also invested heavily in its wealth direction and investment portfolio.

As rightly quoted past Terry Angelos, SVP, Global Head of FinTech at Visa

''There are many lessons to be learned from emerging markets for the U.South. FinTechs, but perhaps the nigh important trend we’re seeing and could learn from today is the Fintech super app.''

Lessons from the Asian Fintech Mural

Here are some key lessons gleaned from the Asian FinTech majors and disrupters that could assistance yous build the next fintech unicorn.

Wait Beyond Your Horizons

Ping An, a well-known Chinese FinTech, started equally a state-endemic insurance company. Today, customers can keep their cash with Ping An’s depository financial institution or invest it through Lufax, its wealth-advisory arm. They can also sign up for education services or purchase a automobile and then finance the payments through its consumer credit unit. Lufax besides uses a facial recognition tool for business relationship opening, like many other fintech companies in Prc that are leveraging the ability of AI/ML to make digital banking more than secure.

Tencent is still some other interesting example in this category. Tencent’south core business concern is not fiscal services just social networking channeled through its social messaging platform – WeChat. Using WeChat, Tencent offers users a wide variety of services, such as online shopping, booking taxis, and ordering meals. Past integrating these services and designing powerful experiences centered on consumers’ everyday needs, WeChat has gained relevance in users’ daily lives and has almost become indispensable for most Chinese people.

Create a Frictionless Customer Experience

The rising of technology in financial services has thankfully dispensed the demand to look at physical branches to bear out uncomplicated monetary transactions. Modernistic customers are increasingly looking for personalized solutions to manage their coin and other aspects of life. For the aforementioned reason, payment apps accept go exceptionally popular, thank you to the simple and easily navigable UX/UI.

For instance, Piggipo, a Thailand-based app for managing multiple credit cards via one interface, securely monitors spending and helps with scheduling payments, saving money and fourth dimension. Besides convenience, Piggipo enables users to meet their credit carte du jour statement in existent-time, set spending limits, and view each carte du jour’due south due date.

Focus on Creating Engagement

WeChat Pay is ane of the all-time-known fintech disruptors from China. At the time of its launch, Tencent used an exciting gamification characteristic known as digital red envelopes to increase engagement and retentiveness. These cerise envelopes could be filled with virtual cash or games and sent by users to other groups. The users in a group would then compete against each other to win the blood-red envelope, making the platform highly engaging and adding to its popularity.

Here’s some other instance from Ant Fiscal that launched Ant Forest to advantage customers using AliPay to pay their bills or perform activities to lower their carbon footprint, such every bit using public transportation.

Engagement is not merely express to customers. The all-time solutions come from hiring the best talent in your team. To achieve this, Gojek fabricated a conscious effort to make working in the company an attractive proposition. They encouraged content on platforms like Medium, of their designers and engineers writing about how they solved several consumer problems. Past highlighting their employees’ achievements, the company gave an insight into its productive work culture that acted equally a hook for attracting more talent.

Increased Focus on Customer-Centricity

Asia is domicile to a few of the world's biggest Fintech unicorns, and the venture capitals keep flowing in. Conducive market conditions, including a large number of tech-savvy audiences, along with the disadvantages of the traditional cyberbanking model have cumulatively meant that the consumers have been targeted at just the correct time. For case, half the population of Indonesia is under 30, and the smartphone penetration crossed 50% very recently. This means consumers are waiting to avail themselves of services through their smartphones and the cyberspace.

Additionally, many of these companies have spent heavily on loyalty and user memory, whether it is through point-based reward systems (Cred), offering discounts and coupons (Gojek), or earning positive equity through various campaigns aimed at genuinely helping people in their times of demand (KoinWorks). For instance, KoinWorks launched the KoinWorks Cares program to brainwash users about safe investment options during the pandemic. They also started a massive donation entrada providing a sizable insurance cover for gratuitous to all the donors and used the nerveless funds to purchase test kits for Indonesian citizens.

In Asia, the appraisal of loan applications, approval, and disbursement accept all become simplified. There is no dearth of digital payment options, with giants like Amazon and Google recognizing the potential market for payment in India. Meanwhile, China already boasts three of the highest-grossing digital payments companies in the world. This has too created opportunities in Asia for venture capitalists to fund start-ups that provide FinTech services – something that the US needs to work on. Although the United states has more FinTech startups (5,799) than Asia (two,849), the FinTech deal counts the difference between the 2, at the end of 2019 Q3, was 152 (Asia) as opposed to 156 (US).

Uncanny Partnerships Lead to Big Rewards

No business is an island, and cross-manufacture partnerships could assist in optimizing customer experiences beyond the board. The data interoperability agreement between JD Finance and Tencent is an instance. JD uses data from WeChat’south messaging platform to make production recommendations to customers and helps vendors with their products.

The EY Global FinTech Adoption Index 2019 besides points to the rise of non-financial services companies such equally retailers, applied science platforms, and automakers developing their technology-enabled financial services offerings. These organizations have built upon existing relationships with customers to offer holistic propositions accompanied by complementary services, such as insurance and lending that were once the exclusive purview of fiscal providers, says the report.

Leveraging Emerging Tech to Drive Better Customer Experiences

While the use of AI has become commonplace for Asian FinTech players, many are now dabbling into newer tech like blockchain to disrupt the financial services industry farther. While there are but a few examples of companies presently using blockchain in their product or service offerings, technology'south decentralized nature volition be a significant game-changer regarding security and speed for fintech companies.

Galileo Platforms, a technology platform company serving the insurance sector in Hong Kong, uses blockchain technology to connect distributors and insurers, enabling them to procedure real-time transactions. Mai Capital specializes in blockchain and cryptocurrency investments. Their flagship production is the Blockchain Opportunity Fund, a multi-strategy hedge fund deploying quantitative trading and arbitrage strategies.

In Conclusion

The world of financial services has undergone tremendous developments in the past few years. Nonetheless, a lot of these changes are not attributable to bankers. Instead, people in business organisation, entrepreneurs, and engineers have been chiefly responsible for the FinTech revolution in Asia and beyond. Instead of waiting for the traditional banking industry to evolve, these people took information technology upon themselves to address client needs by involving cardinal players.

Another cistron responsible for the growth of FinTech in Asia is the constant evolution and rapid digital transformation. Accept the example of China's Pismire Financial: In 2019, the company had a reported valuation of effectually USD 150 Billion. That's well-nigh equal to the valuation of Goldman Sachs (USD 79.46 Billion) and Morgan Stanley (USD 79.05 Billion) combined. This was possible after the company shifted from a sole payment provider to an all-around fiscal services provider in a year. They were able to encompass the needs of the market and predict the upcoming trends well in advance. This ensured they could become a global force past providing convenient finance options to the majority unbanked population in both China and Asia equally a whole.

Even if we expect further than FinTech, in that location’s hardly whatsoever industry that can resist digital transformation at this time. Whether information technology is edifice efficiencies in product design, employee and customer experiences, or building more transparency into the supply concatenation – upgrading your existing technology stack is the most viable solution to run into your organizational goals.

Furthermore, the pandemic has fuelled the requirement for remote experiences and touchless transactions. Every bit a upshot, enterprises are increasingly investing in cloud management platforms, digital payment solutions, and employee feel direction tools to build more productivity into their day-to-solar day work.

">The success story of Asia'south FinTech industry is something that the rest of the world is at present trying to emulate. FinTech in the US is just first to catch up, peculiarly after the pandemic hit and digital channels became a necessity. This Economist article suggests that in the US the volume of transactions on PayPal was 36% higher in March 2021 than last year. The number of people using Square'due south digital Cash App rose past 50% to 36 million during 2020. While the FinTech market in the United states of america is growing, it is still to reach the scale and maturity that the Asian markets accept achieved in the last few years.

Asia is a hub for some of the almost avant-garde FinTech markets and information technology continues to be so. A recent EY survey shows that Asia has retained its global leadership in FinTech adoption this year too. FinTech adoption in Asia-Pacific markets has grown enormously in the final ii years. Markets like Hong Kong, Singapore, and Republic of korea take seen a consumer adoption rate of 67% , simply Communist china and India are spearheading the FinTech growth and are at close to 87% adoption rate.

Factors responsible for this accelerated growth and adoption include consumer demand, market-friendly government policies, high mobile penetration, and reliable net infrastructure. The ascension of Super Apps isouthward alsoone of the nigh of import aspects that accept led to Asia's FinTech growth.

Contents

- 1 Defining Trends From the Asian FinTech Landscape

- one.1 Rise of Neobanks or Digital-Only Banks

- 1.2 Growing Importance of eKYC in Digital Onboarding

- ane.three The Ecosystem Approach to Selling Insurance

- 1.4 Mobile Peer-to-Peer (P2P) Lending Platforms

- i.5 The Rise in QR Code Payments

- 1.vi Use of AI/ML for Personalized Service Offerings

- 1.7 The Super App Revolution

- 2 Lessons from the Asian Fintech Landscape

- 2.1 Wait Beyond Your Horizons

- 2.2 Create a Frictionless Client Experience

- 2.3 Focus on Creating Engagement

- 2.four Increased Focus on Customer-Centricity

- two.5 Uncanny Partnerships Lead to Big Rewards

- ii.6 Leveraging Emerging Tech to Bulldoze Better Customer Experiences

- 2.7 In Decision

Defining Trends From the Asian FinTech Landscape

The FinTech landscape in Asia has matured significantly over the years. COVID-19 is also driving a major shift in user behavior towards fiscal services. There'south been a rapid increase in the use of digital payments , online shopping, adoption of open banking, and more that take reset the BFSI sector as nosotros know it.

Here are some of the key trends from the Asian FinTech landscape and what they could hateful for the residuum of the world.

Ascent of Neobanks or Digital-Only Banks

Neobanks are online-only banks and do not have any physical branches. In the present context of the global pandemic, it is only natural that neobanks take go pop. Yet, aside from the pandemic, the other factors that have fuelled the popularity of digital banking in Asia are:

- A large unbanked population got access to credit and essential financial services at lower costs through these FinTech players.

- The ASEAN population is primarily immature, and Neobanks are especially appealing for younger people who don't want to go to the physical branches.

- The governments and regulatory agencies support the digital movement in these areas. In 2019, regulators in Hong Kong issued viii digital banking licenses. Singapore has also granted some digital cyberbanking licenses while Malaysia and the Philippines are opening upwardly applications gradually.

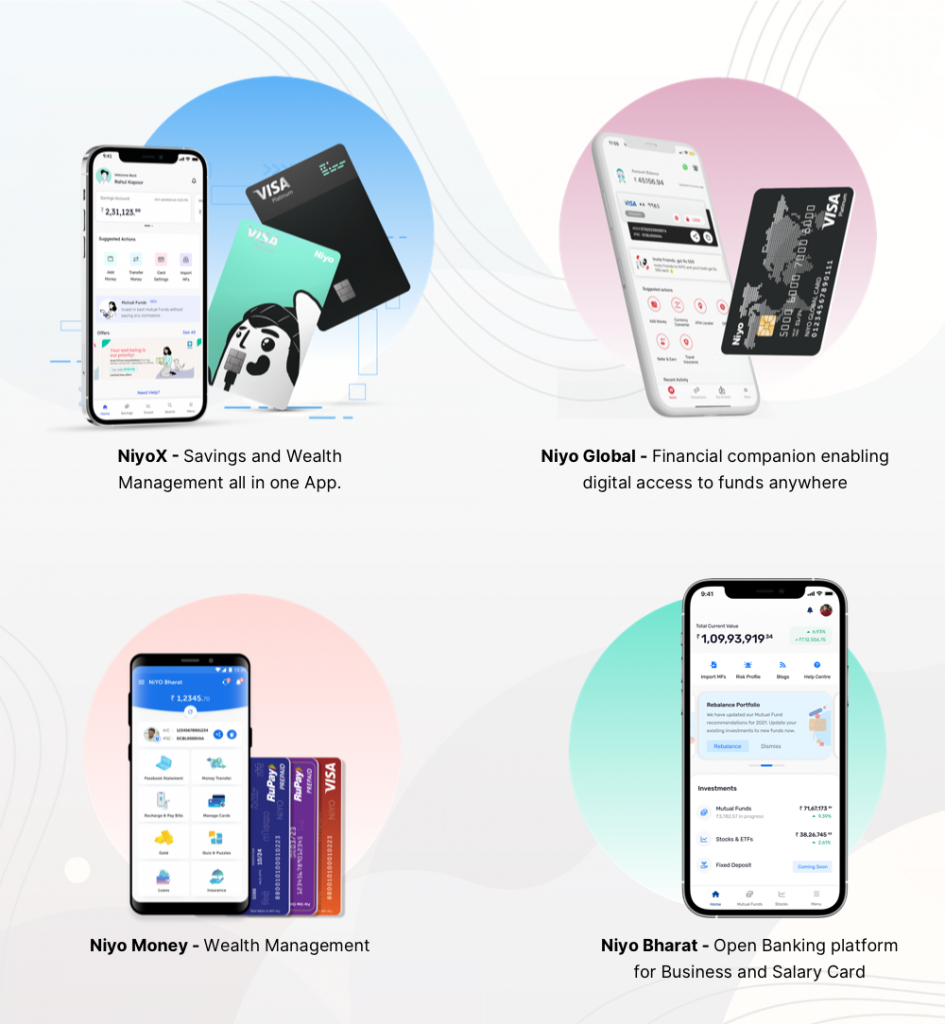

The contempo player in the field in India is Niyo , committed to making banking simpler, safer, and smarter through its suite of services. Fintech has partnered with some of the leading banks in the country to revolutionize traditional cyberbanking services through engineering science integration.

Various offerings from Niyo

At Robosoft, westwardeast partnered with India'southward first cross-border neobank to create an app that allows users to conveniently operate and spend coin beyond the globe. The app enables users to open and operate a multi-currency bank account digitally and instantly on the app.

Growing Importance of eKYC in Digital Onboarding

In the present times, even though consumers want to engage with a bank, they're unwilling to visit a branch. The ongoing pandemic has been a major commuter of this shift. In such a scenario, businesses that offer a superior onboarding feel and digital services are critical.

At Robosoft, we partnered with India's offset virtual private wealth management platform, to create a seamless UI/UX design for the app to allow for KYC-compliant (Know Your Customer) easy registration and onboarding and Touch ID enabled login.

In Asia, the FinTech marketplace is led past People's republic of china and India, two economies with already well-established systems of civil identity. WeChat Digital Identity in China and Aadhar in Republic of india are leveraged by tech providers to enable eKYC, making the onboarding procedure frictionless.

WeChat Digital Identity

The Ecosystem Approach to Selling Insurance

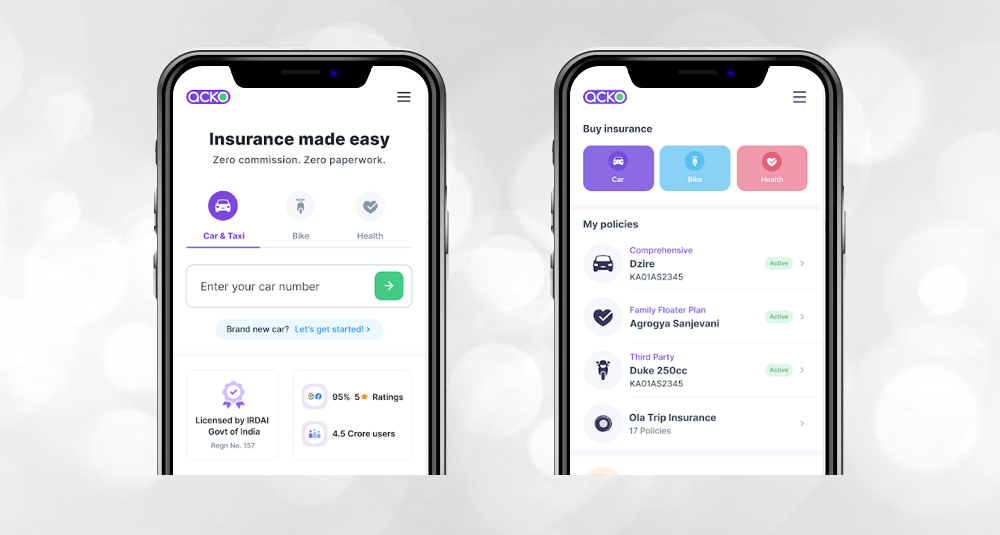

Acko is a fully digital full general insurance company based in India. It provides personalized pricing to customers using deep-data analytics. Information technology too studies customers' behaviors and interaction patterns to suggest insurance products accordingly. Another innovative offering by Acko is Ola Ride Insurance. If you've booked an Ola Ride, you can notice a checkbox to insure your ride. The service allows you lot to instantly secure a cover for lost baggage (including laptops), missed flights, as well equally unplanned medical expenses. Pretty convenient, right?

This is an instance of embedded insurance that solves ane of the biggest problems of the industry – that insurance is sold, not bought.

ACKO Insurance – a unmarried platform for Bike, Machine and Health Insurance

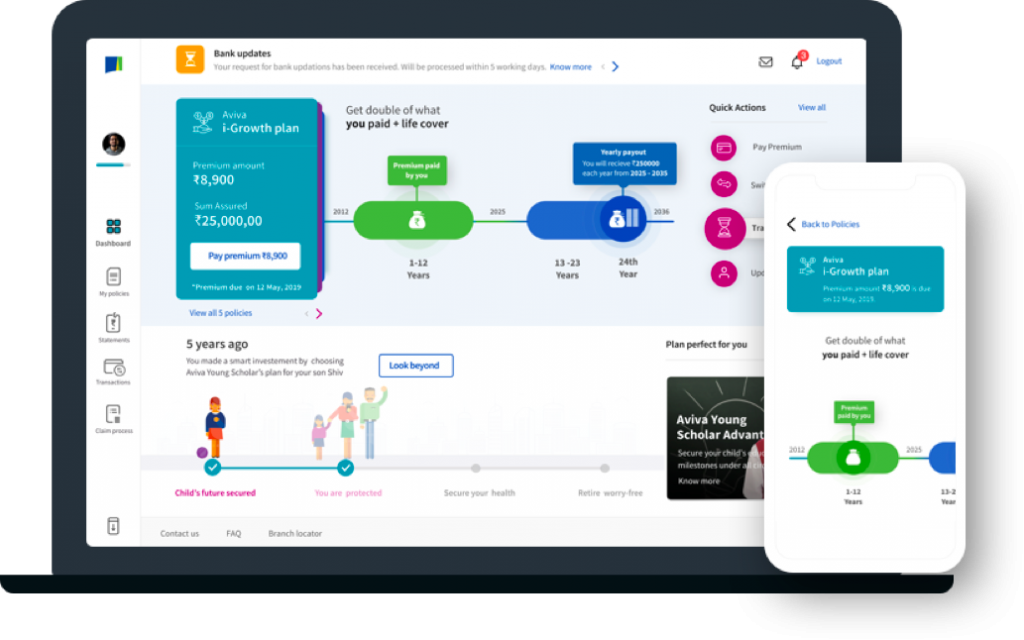

Nosotros partnered with Aviva Aviva Life – one of the leading life insurance companies in India, to redesign their website. The website revamp changed the perception nearly life insurance products by connecting them to the celebration of life instead of being a risk mitigation tool. Nosotros created a multi-engaging experience design that was engaging and showcased Aviva's range of products aligned with private milestones in a person'south life.

Aviva Life Insurance Spider web and Mobile Platform

Mobile Peer-to-Peer (P2P) Lending Platforms

Asia Pacific has emerged as a leader in the mobile peer-to-peer (P2P) money transfer market. According to information, Asia Pacific is the home to more than half of the smartphone users across the globe. The availability of low-toll smartphones and increasing disposable incomes in the region accept fuelled the popularity of P2P financing platforms. Well-nigh governments in the APAC region have also been actively promoting digital payment initiatives, which has helped reduce the costs associated with money transfer (such as UPI in Bharat).

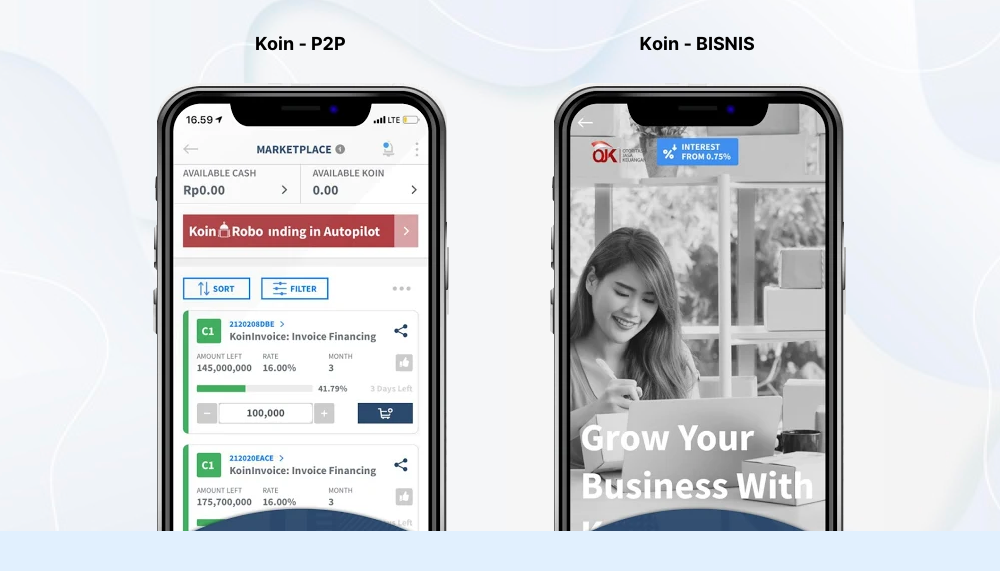

KoinWorks is one of the leading digital lenders in the growing P2P lending infinite in Indonesia. The FinTech house has enabled thousands of SMEs to admission credit and abound their business through a simple app-based lending platform. In Republic of india besides Paytm, players like Telephone Pe, BHIM UPI, etc. have become popular.

KoinWorks – cash business loan credit platform

The Ascension in QR Code Payments

Alipay and Tencent kickstarted QR code-based payment systems, making mobile payment the almost pop payment method in China. Before long, QR code payments have reached Africa, and other countries in the Asia Pacific are rolling out national QR code standards for broad adoption. In the present times, social distancing and personal hygiene have become essential aspects of our lives. In this situation, QR code-based payment systems provided a condom and utterly contactless method for sending and receiving coin, which was a great enabler for pocket-size businesses in most parts of Asia. During the lockdown restrictions in 2020, India's 12 lakh robust Kirana retail organization drove the cashless revolution in the country. Many shifted to digital payment systems to run across the needs of their customers in a safe and contactless manner. Paytm went a step ahead to launch Paytm SoundBox , a vocalism-activated POS (signal-of-sale) machine for minor merchants. Shaped like a small speaker, the SoundBox supported multiple payment methods.

Paytm Sound Box

Employ of AI/ML for Personalized Service Offerings

Personalization is the solution to building trust and loyalty for any organisation. This is one of the principal reasons behind the growing popularity of AI in banking and other FinTech solutions. ML algorithms tin assistance analyze customers' data and predict the services that would be the most appreciated by them. For instance, Coverfox uses AI-based insights to enable users to compare and choose from a range of insurance plans from various companies.

Paytm, on the other hand, uses an AI-based routing engine to attain improve payment success rates.

"Our partnered merchants spend massively on client acquisition and retention. The last thing they want is losing a customer due to payment failure. We are excited to introduce an AI-based routing engine that addresses this problem by optimising the payment workflows and routing the transaction to best-performing payment aggregator in real time. Farther, this will help online merchants reduce evolution effort to enable diverse PG providers and achieve faster time to market." – Puneet Jain, Vice President – Paytm Payment Gateway

The Super App Revolution

Super Apps, the "One app to exercise information technology all" concept that became popular in China has now become a global phenomenon.

Paytm, India's largest mobile payments and due east-commerce platform tin can be safely called India'south first Super App. It allows users to do multiple things similar transfer money, buy gold, book tickets, and fifty-fifty make hotel reservations. Presently, Paytm has over 150 one thousand thousand+ monthly agile users and the highest marketplace share in offline merchant payments with 15% month-on-month growth. Paytm has besides invested heavily in its wealth management and investment portfolio.

Equally rightly quoted by Terry Angelos, SVP, Global Head of FinTech at Visa

''There are many lessons to be learned from emerging markets for the U.S. FinTechs, but perhaps the most important tendency we're seeing and could larn from today is the Fintech super app.''

Lessons from the Asian Fintech Landscape

Here are some key lessons gleaned from the Asian FinTech majors and disrupters that could help you build the next fintech unicorn.

Expect Beyond Your Horizons

Ping An, a well-known Chinese FinTech, started as a state-owned insurance company. Today, customers can keep their cash with Ping An's bank or invest it through Lufax, its wealth-advisory arm. They can also sign up for education services or buy a car and then finance the payments through its consumer credit unit of measurement. Lufax also uses a facial recognition tool for account opening, like many other fintech companies in Red china that are leveraging the power of AI/ML to make digital banking more secure.

Tencent is yet another interesting example in this category. Tencent's core business is not financial services just social networking channeled through its social messaging platform – WeChat. Using WeChat, Tencent offers users a broad variety of services, such every bit online shopping, booking taxis, and ordering meals. By integrating these services and designing powerful experiences centered on consumers' everyday needs, WeChat has gained relevance in users' daily lives and has nigh become indispensable for near Chinese people.

Create a Frictionless Client Experience

The ascent of technology in financial services has thankfully dispensed the demand to await at physical branches to carry out unproblematic monetary transactions. Modern customers are increasingly looking for personalized solutions to manage their money and other aspects of life. For the same reason, payment apps have become exceptionally popular, thanks to the uncomplicated and easily navigable UX/UI.

For example, Piggipo, a Thailand-based app for managing multiple credit cards via one interface, securely monitors spending and helps with scheduling payments, saving coin and time. Besides convenience, Piggipo enables users to meet their credit card statement in real-time, set spending limits, and view each card'south due date.

Focus on Creating Appointment

WeChat Pay is ane of the best-known fintech disruptors from Red china. At the time of its launch, Tencent used an exciting gamification characteristic known equally digital red envelopes to increase appointment and retention. These cherry envelopes could be filled with virtual cash or games and sent by users to other groups. The users in a group would then compete against each other to win the cherry envelope, making the platform highly engaging and adding to its popularity.

Here's another example from Ant Financial that launched Emmet Wood to advantage customers using AliPay to pay their bills or perform activities to lower their carbon footprint, such every bit using public transportation.

Date is not just limited to customers. The all-time solutions come up from hiring the all-time talent in your squad. To achieve this, Gojek fabricated a witting effort to brand working in the company an attractive proposition. They encouraged content on platforms similar Medium, of their designers and engineers writing nigh how they solved several consumer problems. By highlighting their employees' achievements, the visitor gave an insight into its productive work culture that acted as a claw for attracting more than talent.

Increased Focus on Client-Centricity

Asia is home to a few of the world's biggest Fintech unicorns, and the venture capitals keep flowing in. Conducive market weather condition, including a big number of tech-savvy audiences, along with the disadvantages of the traditional cyberbanking model take cumulatively meant that the consumers have been targeted at but the right fourth dimension. For case, half the population of Republic of indonesia is under xxx , and the smartphone penetration crossed l% very recently . This means consumers are waiting to avail themselves of services through their smartphones and the internet.

Additionally, many of these companies have spent heavily on loyalty and user retention, whether it is through point-based reward systems (Cred), offering discounts and coupons (Gojek), or earning positive equity through various campaigns aimed at genuinely helping people in their times of need (KoinWorks). For instance, KoinWorks launched the KoinWorks Cares plan to educate users about safe investment options during the pandemic. They also started a massive donation campaign providing a sizable insurance cover for free to all the donors and used the collected funds to buy test kits for Indonesian citizens.

In Asia, the appraisal of loan applications, approval, and disbursement have all become simplified. At that place is no dearth of digital payment options, with giants like Amazon and Google recognizing the potential market for payment in Bharat. Meanwhile, People's republic of china already boasts three of the highest-grossing digital payments companies in the earth. This has also created opportunities in Asia for venture capitalists to fund get-go-ups that provide FinTech services – something that the U.s.a. needs to work on. Although the The states has more than FinTech startups (5,799) than Asia (2,849), the FinTech bargain counts the difference betwixt the two, at the cease of 2019 Q3, was 152 (Asia) equally opposed to 156 (US).

Uncanny Partnerships Pb to Large Rewards

No business organization is an isle, and cross-manufacture partnerships could help in optimizing customer experiences beyond the lath. The data interoperability agreement betwixt JD Finance and Tencent is an case. JD uses data from WeChat'southward messaging platform to make product recommendations to customers and helps vendors with their products.

The EY Global FinTech Adoption Index 2019 also points to the ascension of not-fiscal services companies such as retailers, technology platforms, and automakers developing their applied science-enabled financial services offerings. These organizations have built upon existing relationships with customers to offer holistic propositions accompanied by complementary services, such as insurance and lending that were once the sectional purview of fiscal providers, says the report.

Leveraging Emerging Tech to Drive Better Customer Experiences

While the use of AI has become commonplace for Asian FinTech players, many are now dabbling into newer tech like blockchain to disrupt the financial services industry further. While there are merely a few examples of companies shortly using blockchain in their product or service offerings, engineering science's decentralized nature will be a meaning game-changer regarding security and speed for fintech companies.

Galileo Platforms, a engineering science platform company serving the insurance sector in Hong Kong, uses blockchain technology to connect distributors and insurers, enabling them to process real-time transactions. Mai Uppercase specializes in blockchain and cryptocurrency investments. Their flagship production is the Blockchain Opportunity Fund, a multi-strategy hedge fund deploying quantitative trading and arbitrage strategies.

In Conclusion

The world of fiscal services has undergone tremendous developments in the by few years. However, a lot of these changes are not attributable to bankers. Instead, people in business, entrepreneurs, and engineers have been chiefly responsible for the FinTech revolution in Asia and across. Instead of waiting for the traditional banking manufacture to evolve, these people took it upon themselves to address client needs by involving key players.

Another factor responsible for the growth of FinTech in Asia is the constant development and rapid digital transformation. Have the instance of China's Ant Financial: In 2019, the company had a reported valuation of around USD 150 Billion . That'south virtually equal to the valuation of Goldman Sachs (USD 79.46 Billion) and Morgan Stanley (USD 79.05 Billion) combined. This was possible subsequently the visitor shifted from a sole payment provider to an all-around financial services provider in a year. They were able to encompass the needs of the marketplace and predict the upcoming trends well in advance. This ensured they could go a global force past providing user-friendly finance options to the majority unbanked population in both People's republic of china and Asia as a whole.

Even if we look further than FinTech, there's hardly any industry that can resist digital transformation at this time. Whether it is edifice efficiencies in production design, employee and customer experiences, or building more transparency into the supply chain – upgrading your existing engineering stack is the nearly viable solution to meet your organizational goals.

Furthermore, the pandemic has fuelled the requirement for remote experiences and touchless transactions. As a issue, enterprises are increasingly investing in cloud management platforms, digital payment solutions, and employee experience management tools to build more than productivity into their twenty-four hours-to-day work.

Vinodh has performed a diversity of roles at Robosoft including managing client enquiries and ongoing relationships. He is currently the Vice President and Geo Head of Europe, Middle E and Africa markets. In his career he has managed a diverse set of IT projects - from games & entertainment to utility services.

Vinodh has performed a diversity of roles at Robosoft including managing client enquiries and ongoing relationships. He is currently the Vice President and Geo Head of Europe, Middle E and Africa markets. In his career he has managed a diverse set of IT projects - from games & entertainment to utility services.

Source: https://www.robosoftin.com/blog/fintech-asia-success-stories-and-learnings

0 Response to "what are large banks in asia doing in regards to fintech"

Post a Comment